8 JUNE 2020

YOUR WORDS

Readers are invited to add their comments to any story. Click on the article to see and add.

BTN DISTRIBUTION

BTN also goes out by email every Sunday night at midnight (UK time). To view this edition click here.

The Business Travel News

PO Box 758

Edgware HA8 4QF

United Kingdom

info@btnews.co.uk

© 2022 Business Travel News Ltd.

Article from BTNews 8 JUNE 2020

ON THE SOABOX : Professor Rigas Doganis & Augusto Viansson Ponte

“Beyond the Virus – Too Many Unknowns”

Covid-19 has turned traffic forecasting upside-down!

Covid-19 has turned traffic forecasting upside-down!

Before the pandemic it was relatively easy to produce short-term forecasts – one extrapolated recent trends – but much more difficult to generate long-term forecasts. Now the opposite seems to be true. There are so many Covid-19 related uncertainties affecting travel in the near future that short-term forecasts appear virtually impossible, while forecasting beyond three years or so appears to be more straightforward.

As the situation persists and governments around the world deploy different measures to fight the pandemic, the consequences of the passenger demand collapse are growing deeper. Recovery is further dampened by damaged economies generating lower disposable incomes. These together with likely permanent shifts in travel behaviour will have severe repercussions on short- and mid-term travel demand.

The Airline Management Group Ltd (AMG) has developed a sophisticated tool to model multiple scenarios based not only on economic but also on behavioural, regulatory and pricing assumptions. The aim is to resolve the short-term forecasting enigma by incorporating current uncertainties into the model in order to help industry players successfully implement their restructuring plans.

A flexible disaggregate tool to evaluate uncertainties

The tool enables scenarios to be evaluated based on a set of economic, regulatory, behavioural and pricing assumptions, divided into five main categories, each further subdivided into more granular primary and secondary drivers.

Historically passenger forecasting has largely relied on the correlation between economic activity trends and passenger growth. A number of additional drivers are however clearly coming into play in the short- to medium-term, impacting how the aviation sector will emerge from the pandemic.

In addition to the well understood economic activity-based forecasting assumptions, AMG’s tool puts particular emphasis on three drivers likely to have very significant impact on demand growth:

- Containment Stages: measuring the degree of severity of the pandemic containment policies across the various regions, correlated to the speed at which contagions/deaths are decreasing in each region and how quickly containment policies are gradually relaxed.

- Behavioural Drivers: measuring the degree of any permanent shift of travel demand arising from safety concerns but also from the impact of the impediments to travel such as more stringent checks, social distancing, sanitisation and other measures.

- Pricing and Cost Drivers: measuring the impact that changes in fares and additional unitary cost transfer to the passenger are likely to have through price/demand elasticities.

Such a tool to produce short-term demand growth scenarios could be invaluable for airlines or airports whether making global or disaggregate forecasts for particular markets or regions. Two case studies, using the tool, illustrate its potential practical uses.

Industry overall impact: understanding the scale of global demand

In terms of global passenger demand forecasting, a significant reduction is expected to last well into 2021 and beyond, with the most significant impacts occurring in Europe, North America and South America, while Asia Pacific is likely emerge from the contraction earlier.

With the current notable exceptions of India and Russia, Asia Pacific appears to be the region with the faster lockdown exit prospects, largely due to an earlier outbreak of the pandemic, a successful early implementation of lockdowns, track and trace programmes and the rapid decrease in infections throughout the region. As the region's economic activity is forecast to start recovering faster and stronger than other regions, demand is expected to rebound both domestically and in the very large intra-regional market, helped by a younger average population less susceptible to Covid-19 travel behavioural changes.

In Europe a lack of coordinated policies in easing the lockdowns and re-establishing freedom of movement throughout the region is creating significant confusion, causing a delayed rebound in demand. Furthermore, the economic pick-up is expected to be less strong than in Asia Pacific. Furthermore, the older demographics will have a significant impact on travel behaviour.

North America, although hit slightly later by the pandemic, is likely to start recovering earlier than Europe in terms of demand, mainly thanks to its large US domestic market and the lack of cross-border regulatory complications.

On the other hand, South America is expected to have a slower recovery in demand due to the magnitude, timing and generally unsuccessful response to the pandemic, especially in its largest market Brazil, causing both intra-regional and international traffic to remain substantially subdued.

As shown in the diagram above, using its own modelling, AMG believes the reduction in customer demand will be substantial for some time and traffic is unlikely to return to 2019 levels within the next two years or more. Moreover, our view is that the recent industry forecasts, such as IATA's in April 2020 are likely to be over-optimistic especially in the short term. The AMG base case scenario predicts global traffic levels by the end of this year 40% to 50% lower than other industry forecasts.

Impact on airlines: making well informed restructuring decisions

As a case study at a more specific level we have used our forecasting tool on a sample mid-sized international carrier, operating a mixed fleet of 25 narrow- and 15 wide-body aircraft, to implement right-sizing and growth strategies and to assess their financial implications.

The analysis showed that even after right sizing and the implementation of a range of cost cutting measures, including return of leased aircraft without significant penalties and a reduction in labour costs through temporary layoffs, furloughs and voluntary retirements, margins will remain substantially reduced to the end of 2021 and beyond.

A low case where these measures are not implemented shows a significant further financial deterioration. This highlights the importance of the need for immediate action by airlines to mitigate the impact from demand reduction, informed by granular passenger demand evolution scenarios.

The impact of the pandemic will be long-lasting on passenger demand, which will remain considerably below its 2019 peak for a number of years.

Understanding the short-term demand scenarios at a granular, disaggregate level will be of paramount importance to airlines and other industry players. A careful and informed implementation of cost containment measures together with the planning of a gradual increase in capacity as demand allows will be critical in reducing losses by significant amounts and in helping to secure the restructuring necessary for longer term sustainable operations beyond Covid-19.

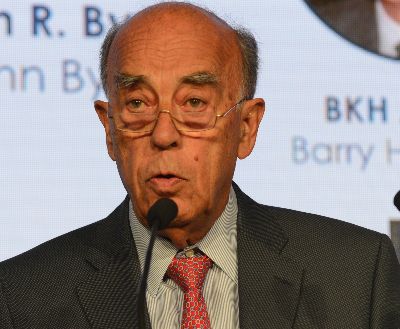

Professor Rigas Doganis is Chairman, Airline Management Group Ltd (AMG) and instigated the highly successful Air Transport Department at Cranfield University. A former Chairman/CEO of Olympic Airways he has been a non-executive Director of South African Airways, easyJet and Hyderabad Airport. Author of "Flying Off Course – Airline Economics and Marketing" (5th edition 2019). Chairman, European Aviation Club, Brussels.

Augusto Viansson Ponte (Director Strategy & Planning) has been involved in several airline turnaround and performance improvement programmes including South African Airways, Alitalia, Norwegian, Air Malta, LOT Polish Airlines, Meridiana and Caribbean Airlines, and has worked on a number of start-ups including SalamAir and Go-Fly.

www.btnews.co.uk

rigas.doganis@airline-management.com and/or augusto@airline-management.com

www.airline-management.com

OUR READERS' FINEST WORDS (All times and dates are GMT)

All comments are filtered to exclude any excesses but the Editor does not have to agree with what is being said. 100 words maximum